Choose the Right Platform for Your Trading Success

Selecting the right trading platform is one of the most important decisions you’ll make as a trader. At Olix Academy, we’ve thoroughly researched and vetted numerous platforms to help you make an informed choice that aligns with your trading goals, experience level, and financial objectives.

Choose the Right Platform for Your Trading Success

Whether you’re preparing for your FINRA licensing exams or already working as a financial professional, understanding different trading platforms is essential for your career success.

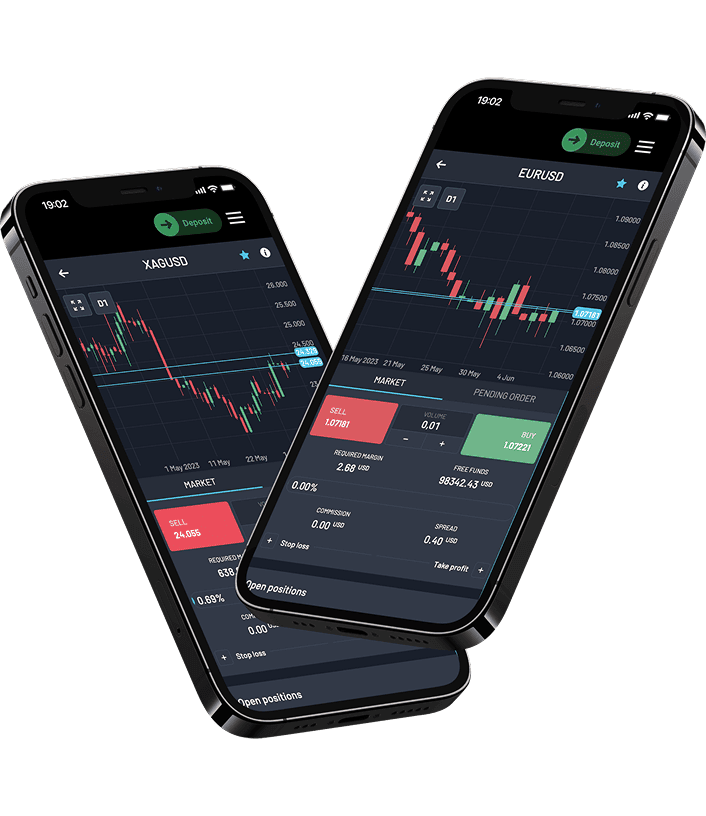

FXPRO

Ideal for experienced traders and financial professionals who need comprehensive market access and advanced features.

$500 / Account minimum deposit

ETORO

Perfect for traders who want premium features without premium costs, offering excellent value for money.

$250 / Account minimum deposit

AVATRADE

Designed specifically for new traders and those starting their financial services career.

$500 / Account minimum deposit

Our Comprehensive Platform Vetting Process

Before recommending any trading platform, we conduct rigorous evaluation based on eight critical criteria:

Regulatory Compliance

Only platforms licensed by reputable financial authorities such as the FCA (UK), SEC (US), or other recognized regulatory bodies. We verify all licensing and regulatory status before recommendation.

Security Standards

Advanced encryption protocols, segregated client funds, and comprehensive fund protection measures. We ensure your capital and personal information remain secure.

Trading Costs

Transparent fee structures, competitive spreads, and no hidden charges. We analyze total trading costs to ensure you get the best value for your investment.

User Experience

Intuitive interfaces suitable for various skill levels, from beginner-friendly layouts to professional-grade advanced features for experienced traders.

Educational Resources

Quality learning materials, market analysis tools, webinars, and educational content that support continuous learning and skill development.

Customer Support

Responsive and knowledgeable support teams available when you need assistance, with multiple contact methods and reasonable response times.

Platform Stability

Reliable trade execution, minimal downtime, fast order processing, and robust infrastructure that can handle market volatility.

Asset Variety

Diverse trading instruments including stocks, forex, commodities, indices, and other markets to support various trading strategies.