The triple bottom pattern is one of the most reliable bullish reversal formations in technical analysis. This comprehensive guide explores how traders identify and profit from this powerful chart pattern.

What Is a Triple Bottom Stock Pattern?

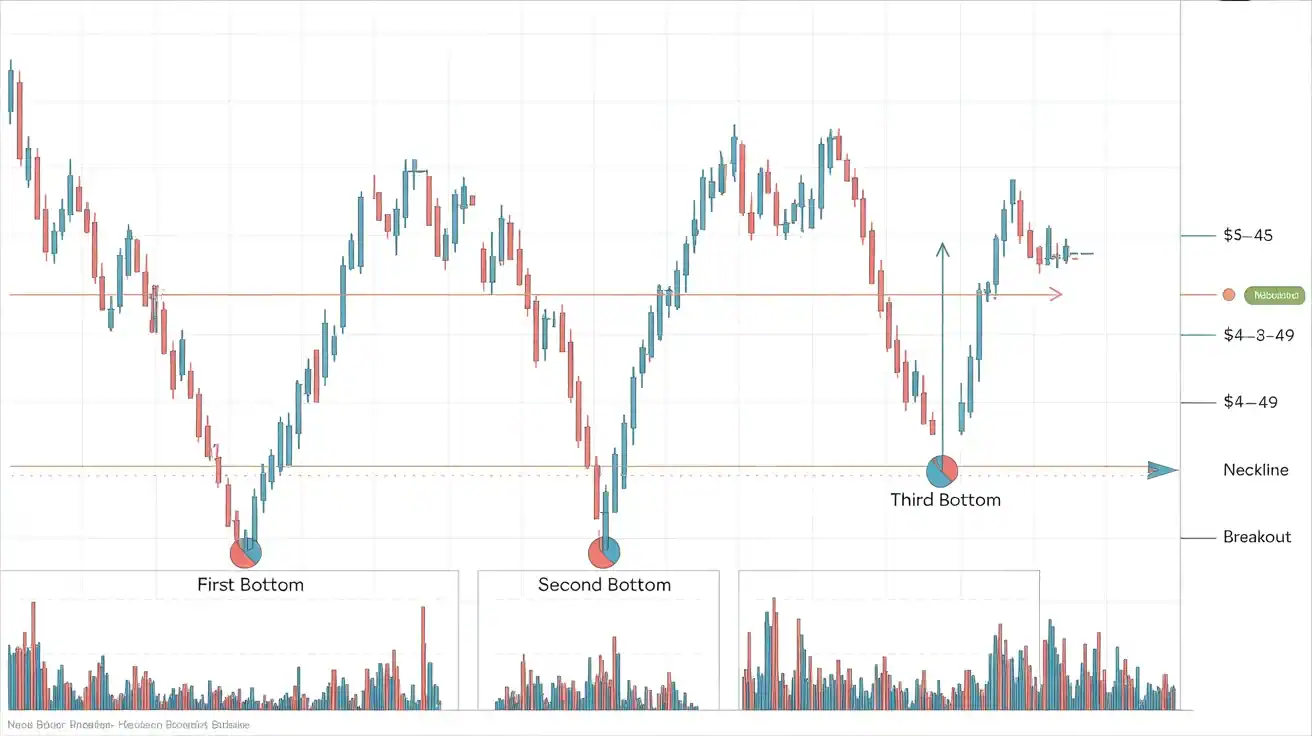

A triple bottom is a bullish reversal pattern that forms after an extended downtrend. It consists of three distinct price lows at approximately the same level, separated by two moderate peaks. The pattern signals that selling pressure is exhausting and buyers are gaining control.

The three troughs demonstrate that the asset has tested a support level multiple times but failed to break below it. Each failed breakdown attempt weakens bearish momentum and strengthens the case for an upward reversal. When the price finally breaks above the resistance line connecting the two peaks, it confirms the pattern and signals a potential trend change.

Key characteristics include:

• Three distinct lows at similar price levels (within 2-3% variation)

• Two intervening peaks forming a resistance line

• Decreasing volume during the bottoming process

• Volume spike on the breakout above resistance

How the Triple Bottom Pattern Works

The triple bottom pattern unfolds through distinct psychological phases that reveal the battle between buyers and sellers:

Phase 1: First Bottom – After a downtrend, the price reaches a low where buyers step in, creating initial support. However, buying interest remains weak, and the rally is short-lived.

Phase 2: Second Bottom – The price declines again to test the previous low. Buyers defend the same support level, demonstrating that sellers cannot push prices lower. This creates a stronger floor.

Phase 3: Third Bottom – A final decline tests the support level once more. When buyers absorb selling pressure at this level for the third time, it confirms strong accumulation and signals exhaustion of the downtrend.

Phase 4: Breakout – With sellers exhausted, buyers push the price above the resistance line (neckline) connecting the two peaks. This breakout, ideally on high volume, confirms the reversal and triggers additional buying from traders who were waiting for confirmation.

The pattern works because it demonstrates a clear shift in market psychology. Each time the support holds, more bears give up and more bulls gain confidence. The triple test creates a high-conviction support zone that, once broken to the upside, often leads to a sustained rally.

Triple Bottom Pattern Psychology (Very Underrated)

The psychological dynamics underlying the triple bottom pattern are crucial to understanding why it works and how to trade it effectively. This aspect is often overlooked by traders who focus solely on the visual pattern.

Seller Exhaustion: After an extended downtrend, weak hands have already exited their positions. Each time the price tests the support level and bounces, more short sellers are forced to cover, and panicked long holders have already sold. By the third test, there are simply fewer sellers willing to push prices lower.

Accumulation by Smart Money: Institutional investors and experienced traders recognize value at the support level. Each bounce confirms their thesis, and they incrementally build positions. The repeated tests create conviction that this is a favorable entry point.

Fear of Missing Out (FOMO): Traders watching from the sidelines see the support holding three times and begin to believe the bottom is in. When the breakout occurs, this creates a rush of buying as traders fear missing the reversal.

Short Squeeze Potential: Short sellers who entered positions during the downtrend face increasing pressure as the support holds repeatedly. The breakout above resistance often triggers stop-loss orders and forces short covering, accelerating the upward move.

This psychological transformation from bearish to bullish sentiment is what gives the triple bottom its predictive power. It’s not just about the shape on the chart—it’s about the collective shift in trader behavior and market dynamics that the pattern represents.

Triple Bottom vs Double Bottom

While both patterns signal bullish reversals, there are important differences:

Reliability and Strength: Triple bottoms are generally more reliable than double bottoms because the support has been tested three times instead of two. This additional confirmation reduces false signals. However, triple bottoms are also less common, making them harder to find.

Formation Time: Triple bottoms take longer to develop, typically forming over several weeks to months. Double bottoms can form more quickly, sometimes within days or weeks. The longer formation time of triple bottoms allows for more accumulation.

Psychological Conviction: The third test of support in a triple bottom creates stronger conviction among market participants. By the third attempt to break lower, both bulls and bears have more clarity about where the line is drawn.

Breakout Potential: When a triple bottom breaks out, it often produces a more powerful move because of the pent-up buying pressure and the psychological impact of the triple failed breakdown. Double bottoms can also be effective but may produce less explosive moves.

In practice, both patterns are valuable. Double bottoms offer more frequent trading opportunities, while triple bottoms provide higher-confidence setups with potentially larger rewards when they do appear.

How to Identify a Triple Bottom on a Chart

Identifying a valid triple bottom requires attention to several specific criteria:

1. Prior Downtrend: The pattern must form after a clear downtrend. A triple bottom appearing in a ranging or uptrending market lacks the reversal significance and should be interpreted differently.

2. Three Clear Lows: Look for three distinct price lows that touch or come very close to the same support level. The lows should be within 2-3% of each other. If the variation is too large, it may not be a valid pattern.

3. Two Intermediate Peaks: Between the three bottoms, there should be two rally attempts that create peaks. Draw a horizontal line across these peaks to establish the resistance level (neckline) that must be broken for confirmation.

4. Adequate Spacing: The three lows should be spread out over time—typically weeks or months on daily charts. If the lows occur too close together, the pattern lacks significance. Each test should represent a meaningful attempt to break support.

5. Volume Pattern: Volume typically decreases as the pattern forms, showing diminishing selling pressure. Volume should then expand on the breakout above the neckline, confirming strong buying interest.

6. Clean Pattern Structure: Avoid patterns with excessive noise, multiple false bottoms, or irregular structure. The cleaner the pattern, the more reliable the signal.

Use multiple timeframes to confirm the pattern. What appears as a triple bottom on a daily chart should be supported by the broader trend structure on weekly charts. This multi-timeframe analysis increases the probability of a successful trade.

Triple Bottom Pattern Trading Strategy (Step by Step)

Here’s a systematic approach to trading the triple bottom pattern:

Step 1: Pattern Recognition

Scan for stocks or assets that have been in a downtrend and are showing signs of bottoming. Use technical screeners to filter for securities trading near multi-month lows. Look for three distinct touches of a support level with two intervening rallies.

Step 2: Confirm the Setup

Verify that all criteria are met: prior downtrend, three clear lows at similar levels, decreasing volume during formation, and a well-defined resistance line. Check for supporting indicators like RSI showing higher lows (positive divergence) or MACD showing bullish momentum shifts.

Step 3: Entry Strategy

Conservative Entry: Wait for a confirmed breakout above the resistance line (neckline) on strong volume. Enter when the candle closes above resistance. This approach reduces false signals but may result in a less favorable entry price.

Aggressive Entry: Enter on the third bounce from support before the breakout. This provides a better risk-reward ratio but carries higher risk of a false signal. Only use this approach with strong confirmation from other indicators.

Step 4: Stop Loss Placement

Place your stop loss just below the lowest of the three bottoms, typically 2-5% below depending on the asset’s volatility. If the price breaks below all three lows, the pattern has failed and the trade thesis is invalidated.

Step 5: Profit Targets

Target 1: Measure the height from the bottom of the pattern to the neckline resistance. Project this distance upward from the breakout point. This represents the minimum measured move target.

Target 2: Look for previous resistance levels above the pattern where the price may encounter selling pressure. These serve as logical profit-taking zones.

Target 3: For longer-term positions, hold for a retest of the pattern’s high if the breakout is strong. Trail your stop loss as the position moves in your favor.

Step 6: Position Management

Consider taking partial profits at Target 1 and moving your stop loss to breakeven. This locks in gains while giving the remainder of your position room to run. Scale out at multiple targets rather than exiting all at once, especially if momentum remains strong.

Stop Loss and Take Profit Placement

Proper risk management is crucial for successful triple bottom trading. Here’s how to set optimal stop losses and take profit levels:

Stop Loss Guidelines:

Initial Stop: Place 2-5% below the lowest point of the three bottoms. The exact percentage depends on the asset’s average true range (ATR). More volatile assets require wider stops.

Time-Based Stop: If the pattern fails to break out within a reasonable timeframe (typically 1-2 months after the third bottom), consider exiting the position even if the stop isn’t hit. Prolonged consolidation may indicate weakening conviction.

Trailing Stop: Once the price moves 5-10% above the breakout point, trail your stop loss to protect profits. A common method is to trail below each higher swing low, ensuring you exit if the uptrend breaks.

Take Profit Strategies:

Measured Move: Calculate the vertical distance from the pattern’s low to the neckline. Add this distance to the breakout point. For example, if the pattern is 10 points tall and breaks out at 50, your target is 60.

Fibonacci Extensions: Apply Fibonacci extension levels from the low of the pattern through the breakout point. Common targets are the 1.272 and 1.618 extensions.

Previous Resistance: Identify major resistance levels from before the downtrend began. These often act as profit-taking zones.

Partial Exits: Take 30-50% off at your first target, 30% at your second target, and let the remainder run with a trailing stop. This approach balances profit-taking with the potential for a larger move.

A good rule of thumb is to aim for at least a 2:1 reward-to-risk ratio. If your stop loss is 5% below entry, target at least 10% above entry for your first profit level.

Common Mistakes Traders Make

Even experienced traders can fall into these traps when trading triple bottoms:

1. Forcing the Pattern: Not every three-touch support level is a valid triple bottom. Traders often see what they want to see, identifying patterns where they don’t truly exist. A valid triple bottom requires a prior downtrend, proper spacing between lows, and clear intermediate rallies.

2. Entering Too Early: Jumping in after the second bottom or before the breakout confirmation increases risk significantly. The pattern isn’t complete until the price breaks above the neckline. Premature entries often result in losses when the pattern fails.

3. Ignoring Volume: Volume is a critical confirmation tool. Breakouts on low volume are suspect and often fail. The third bottom should show declining volume (seller exhaustion), and the breakout should show expanding volume (buyer conviction).

4. Poor Stop Loss Placement: Setting stops too tight leads to premature exits on normal volatility. Setting them too wide means taking excessive risk. The stop should be below all three lows with enough buffer for normal price fluctuation.

5. Unrealistic Profit Expectations: While triple bottoms can produce substantial gains, not every pattern leads to a massive rally. Setting realistic targets based on the measured move and nearby resistance levels prevents disappointment and overtrading.

6. Trading in Isolation: Relying solely on the pattern without considering broader market conditions, sector trends, or fundamental catalysts reduces success probability. The best triple bottom trades occur when multiple factors align.

7. Neglecting Risk-Reward Ratio: Some traders enter valid patterns but with poor risk-reward setups. If your stop is 10% away and your target is only 5%, you need to be right 70% of the time just to break even. Always ensure favorable risk-reward before entering.

8. Failing to Adapt: If the pattern fails or market conditions change, some traders hold losing positions hoping for recovery. When the price breaks below all three bottoms, the pattern is invalidated and the trade should be exited immediately.

Is the Triple Bottom Pattern Reliable?

The reliability of the triple bottom pattern depends on how you measure success and the context in which it appears.

Statistical Success Rate: Studies on pattern reliability suggest that triple bottoms succeed approximately 60-70% of the time when properly identified and traded with confirmation. This makes them moderately reliable, though not foolproof. Success rate improves significantly when the pattern appears with:

• Strong volume confirmation on the breakout

• Bullish divergence on momentum indicators

• Alignment with broader market conditions

• Positive fundamental catalysts

Factors Affecting Reliability:

Timeframe: Triple bottoms on longer timeframes (weekly, monthly) tend to be more reliable than those on intraday charts. More time allows for genuine accumulation and commitment from market participants.

Market Environment: Patterns forming during bull markets or neutral conditions are more reliable than those in deep bear markets. During severe downtrends, even valid patterns can fail as selling pressure overwhelms.

Pattern Quality: Clean, well-defined patterns with clear support and resistance levels perform better than messy, ambiguous formations.

The Bottom Line: The triple bottom is a reliable pattern when used correctly, but it’s not a guaranteed winner. Success requires proper identification, confirmation, risk management, and favorable context. Traders who wait for confirmation and use appropriate position sizing typically achieve positive results over time.

Like all technical patterns, reliability improves when combined with other forms of analysis rather than traded in isolation.

Triple Bottom Pattern Examples (Charts)

Understanding real-world examples helps traders recognize and validate the pattern in live markets. Here are key characteristics to look for in chart examples:

Classic Triple Bottom Example:

A textbook triple bottom shows three distinct price lows at approximately $45, separated by rallies to $48-49 (the neckline). Volume diminishes with each successive bottom, indicating seller exhaustion. The breakout above $49 occurs on volume that’s 2-3 times the recent average. The stock then rallies to $54-55 (the measured move target) within 4-8 weeks.

Triple Bottom with Divergence:

A stronger variation shows the RSI making higher lows while price makes equal lows. This bullish divergence adds conviction to the pattern. For example, the first bottom corresponds to RSI at 25, the second at 30, and the third at 35, while all three price lows are at the same level. This divergence confirms weakening selling pressure.

Failed Triple Bottom Example:

Not all patterns succeed. A failed triple bottom occurs when the price breaks below all three lows, often on increasing volume. This typically happens when the broader market is in a strong downtrend or when negative fundamental news emerges. The failure itself can become a bearish signal, indicating that support has definitively broken.

When analyzing charts, look for these confirming factors:

• Each bottom should be clearly separated in time (weeks to months)

• The three lows should align horizontally within 2-3%

• Volume should decline through the pattern formation

• The breakout should occur on expanding volume

• Supporting indicators should confirm the reversal

FAQ (to Help You Avoid Featured Snippet Imposters)

What is a triple bottom pattern in trading?

A triple bottom is a bullish reversal chart pattern that forms when an asset’s price tests the same support level three times but fails to break below it. After the third bounce, the price breaks above the resistance level (neckline), signaling a potential trend reversal from bearish to bullish.

How reliable is the triple bottom pattern?

The triple bottom pattern has a success rate of approximately 60-70% when properly identified with confirmation signals like strong breakout volume and bullish momentum divergence. Reliability increases on longer timeframes and when aligned with favorable market conditions.

What’s the difference between a triple bottom and a double bottom?

The main difference is that a triple bottom tests support three times instead of two, making it generally more reliable but less common. Triple bottoms take longer to form and create stronger psychological conviction among traders, often leading to more powerful breakouts when they occur.

Where should I place my stop loss on a triple bottom trade?

Place your stop loss 2-5% below the lowest point of the three bottoms. This accounts for normal volatility while protecting against a pattern failure. If the price breaks below all three lows, the pattern is invalidated and you should exit the position.

How do I calculate the price target for a triple bottom?

Measure the vertical distance from the bottom of the pattern to the neckline resistance. Project this same distance upward from the breakout point. For example, if the pattern is 10 points tall and breaks out at 50, your minimum target is 60.

Can a triple bottom form on any timeframe?

Yes, triple bottoms can form on any timeframe from intraday to monthly charts. However, patterns on longer timeframes (daily, weekly, monthly) are generally more reliable because they represent more significant accumulation and broader market participation.

What confirms a triple bottom breakout?

A confirmed breakout requires the price to close above the neckline resistance on significantly increased volume—typically 2-3 times the recent average. Additional confirmation comes from bullish momentum indicators and sustained price action above the breakout level without immediate reversal.

Should I wait for confirmation before entering a triple bottom trade?

Conservative traders should wait for the confirmed breakout above the neckline before entering. Aggressive traders may enter on the third bounce from support, but this carries higher risk of pattern failure. Waiting for confirmation reduces false signals at the cost of a slightly less favorable entry price.

What causes a triple bottom pattern to fail?

Triple bottoms fail when selling pressure overwhelms buying interest, causing the price to break below all three lows. Common causes include deteriorating fundamentals, broader market downturns, low volume on the breakout attempt, or premature pattern identification before proper formation is complete.

Can I combine triple bottom patterns with other indicators?

Yes, combining the triple bottom with other technical indicators significantly improves accuracy. Useful confirmations include RSI bullish divergence, MACD crossovers, moving average support, and volume analysis. The more confirming signals align with the pattern, the higher the probability of success.

Leave a Reply