Trading Bitcoin can look intimidating from the outside, but once you break it down into clear steps, it becomes much easier to understand and manage the trading process and reduce the risk.

This next “How to Trade Bitcoin” guide walks you through how to day trade bitcoin, where you can trade bitcoin, and how to handle real‑world questions like risk, accounts, and where to keep your coins.

What Does It Actually Mean to Trade Bitcoin?

Trading Bitcoin means attempting to profit from its price movements, rather than holding it long-term. Depending on your strategy, you might hold a position for minutes, hours, or even weeks. depending on your style.

Common ways to trade bitcoin include:

- Spot Trading: Buying and selling actual Bitcoin (like BTC/USD) on an exchange.

- Day Trading: Opening and closing multiple Bitcoin trades within the same day.

- Derivatives: Using Bitcoin futures or other derivatives to speculate on price movements, often with leverage.

Where Can I Trade Bitcoin?

- Crypto exchanges

These let you buy, sell, and trade BTC directly against currencies like USD, EUR, or stablecoins, and sometimes offer margin and futures. - Online brokers

Some regulated brokers offer bitcoin CFDs or futures alongside stocks and forex, so you can trade BTC without actually holding the coin. - Local or regional platforms

In some countries, people search things like “how to trade bitcoin in Canada” or “how to trade bitcoin in India” and end up on local exchanges or services like Coins.ph in the Philippines.

When choosing where to trade bitcoin, pay attention to:

- Regulation and reputation in your country.

- Fees, spreads, and funding/withdrawal costs.

- Security, customer support, and available trading tools.

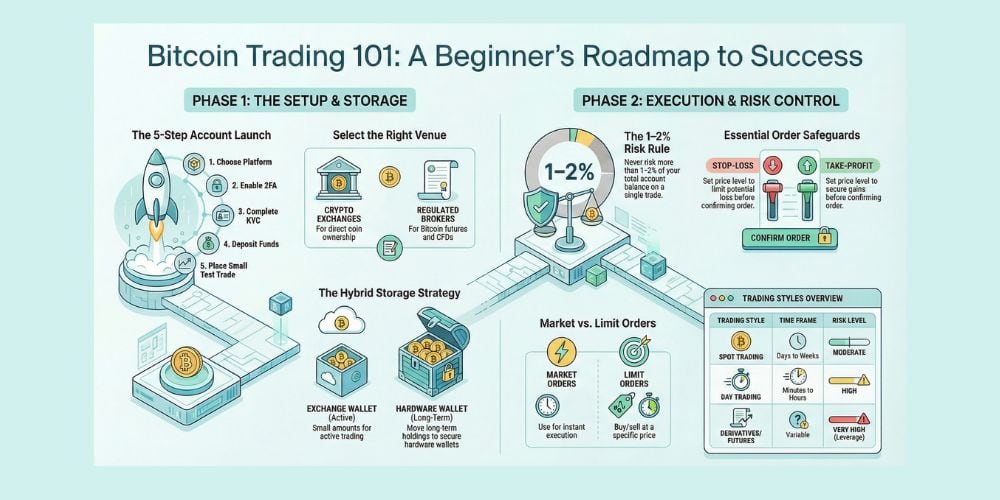

How to Open a Bitcoin Trading Account (Step‑by‑Step)

- Pick a trusted platform

Choose a well‑known exchange or broker that supports BTC trading in your country, including spot bitcoin and, if you want later, bitcoin futures or other crypto trading pairs. - Create your account

Sign up with your email, set a strong password, and immediately turn on two‑factor authentication (2FA). - Complete identity verification (KYC)

Upload ID and any required documents so you can deposit, trade in larger amounts, and withdraw. Most regulated platforms require this, whether you’re trying to trade bitcoin in Canada, India, Australia, or elsewhere. - Deposit funds

Add money to your account via bank transfer, card, or local payment methods. This is the practical step behind “how to buy and trade in bitcoin” or “how to buy and trade bitcoin fast”. - Choose a BTC pair and place a small test trade

Start with a common pair like BTC/USD or BTC/USDT, place a small market or limit order, and get comfortable with how the platform works before you increase your size.

How to Place Your First Bitcoin Trade

Once your account is funded, here’s how to trade bitcoin step by step.

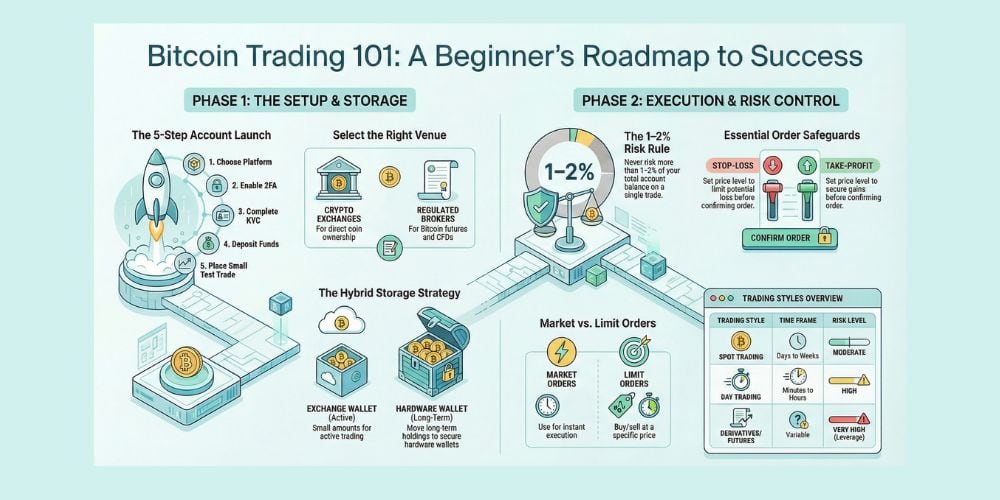

- Decide your style

Are you trying to day trade bitcoin (short‑term, many trades) or swing trade bitcoin (holding for days or weeks)? Your time frame will shape your strategy and schedule. - Pick your order type

- Market order: Buys or sells immediately at the current price.

- Limit order: Lets you choose your own price level to buy or sell.

- Set stop‑loss and take‑profit

Before you click “buy”, decide at what price you’ll cut your loss (stop‑loss) and where you’ll cash in your profit (take‑profit). This is how people who want to trade bitcoin and make profit without blowing up manage risk. - Confirm the trade and monitor it

Check the fees, confirm your order, and then monitor your position or set alerts so you don’t stare at the chart all day.

Mechanically, this is how to trade bitcoin fast or how to actively trade bitcoin — but the real skill is in the planning, not in clicking buttons.

How to Day Trade Bitcoin (And Whether You Should)

Day trading bitcoin means opening and closing trades within the same day, often several times, to capture short‑term price movements. It can be exciting and potentially profitable, but it’s also one of the riskiest ways to approach the market.

What bitcoin day traders usually do:

- Trade only the most liquid BTC pairs with tight spreads, so it’s easier to get in and out at a fair price.

- Use technical tools like candlestick patterns, support and resistance, moving averages, and momentum indicators to plan entries and exits.

- Follow strict daily loss limits and predefined rules to avoid emotional, revenge trading after a losing streak.

But there are serious drawbacks:

- Bitcoin’s high volatility can quickly turn a small intraday move into a large loss if position size or leverage is too aggressive.

- Leverage amplifies both gains and losses and can lead to rapid account wipeouts when trades go against you.

- Because the crypto market trades 24/7, it’s easy to overtrade, lose sleep, and burn out without clear boundaries and a routine.

For most beginners, the safest way to approach day trading is to start with very small size, practice your strategy on higher timeframes or demo accounts, and treat day trading as a skill that develops over time rather than a quick income solution.

How to Trade Bitcoin Futures and Derivatives (Advanced Step)

Trading bitcoin futures and other derivatives is a step beyond basic spot trading and should only be considered once you’re comfortable managing risk on normal BTC trades. Futures and similar products let you go long or short bitcoin without owning the coin directly, often using leverage.

How they work in simple terms:

- Bitcoin futures and perpetual swaps track the price of BTC and allow you to profit from both rising and falling markets by taking long or short positions.

- Leverage lets you control a larger position with less money, but it also means even a small move against you can cause a large loss or even a full liquidation of your margin.

Main dangers:

- High leverage combined with bitcoin’s volatility can wipe out accounts very quickly if position sizes and stop‑losses are not controlled.

- Fees, funding rates on perpetual contracts, and overnight charges can quietly eat into profits, especially for frequent traders.

A sensible way to approach bitcoin futures is to treat them as advanced tools: start with low or no leverage, use small position sizes, and only move into more complex strategies once you already have a consistent, profitable track record in spot trading.

What Are the Real Risks When Trading Bitcoin?

It’s important to understand the main risks of bitcoin trading before committing any active trade.

Key risks:

Volatility risk

Bitcoin tends to be volatile, with significant intraday price fluctuations, which can lead to potential losses in positions.

Leverage risk

Trading with margin amplifies both gains and losses. Beginners may face losses quickly when using high leverage.

Psychological risk

Emotions like FOMO (fear of missing out), panic selling, and revenge trading can lead to impulsive decisions, larger-than-planned trades, and straying from the trading plan after experiencing gains or losses.

Platform risk

Hacks, technical issues, unexpected policy changes, or withdrawal freezes on unreliable platforms can put funds at risk if adequate research isn’t conducted.

Regulation and tax risk

Regulations and tax obligations vary by country, and transactions involving Bitcoin, such as selling or trading, are often taxable events that need to be tracked and reported accurately.

Treating these risks with respect, rather than ignoring them, is a big part of behaving like a disciplined trader instead of a gambler.

Where Do I Keep My Coins When Trading?

There’s no single “best” place to keep bitcoin while trading, but there are a few main options, each with trade‑offs.

On the exchange (hot wallet)

- Pros: Very convenient for active trading, instant access to buy and sell.

- Cons: Funds depend on the platform’s security and policies, so exchange risk is higher.

Software wallet you control

- Pros: You hold your own private keys and have more direct control over your BTC.

- Cons: Coins must be sent back to the exchange whenever you want to trade, which adds time and network fees.

Hardware wallet

- Pros: Strong security for long‑term holdings, especially for larger balances that don’t move often.

- Cons: Less convenient for frequent trading because transferring in and out takes extra steps.

A common approach is to keep a small amount of bitcoin on the exchange for active trading and store the rest in a more secure wallet (software or hardware) for the long term.

How to Trade Bitcoins for Cash (On‑ and Off‑Ramps)

Trading Bitcoin for cash simply means exchanging your BTC for traditional currencies like USD, EUR, or AUD. Here are some common ways to cash in or out:

- Sell BTC on a centralized exchange: Convert Bitcoin to fiat currency (like USD) on a trusted exchange, then withdraw the money to your bank account using a supported payout method.

- Peer-to-peer (P2P) marketplaces: Trade directly with others through platforms that offer escrow and dispute resolution. You can choose bank transfers, cash deposits, or other agreed methods for payment.

- Bitcoin ATMs: Some ATMs let you sell Bitcoin for cash or buy Bitcoin with cash. However, keep in mind that fees at these ATMs are usually higher than those on online exchanges or P2P platforms.

Remember, safety and compliance are crucial. If any part of the transaction involves in-person cash exchanges, always meet in safe, public spaces. Stick to trusted platforms, avoid dealing with unknown individuals, and make sure you follow local regulations regarding KYC (Know Your Customer), AML (Anti-Money Laundering), and reporting to stay compliant.

Country‑Specific Notes (Canada, India, Coins PH etc.)

In many cases, questions about trading bitcoin in specific places like Canada, India, or via Coins.ph are really about which platforms and payment methods are available locally, and what rules apply.

In most countries, the basic process is similar:

- Choose a locally supported, reputable exchange or app

This might be a Canadian or Indian exchange, or a regional service such as Coins.ph in the Philippines, depending on where you live and which fiat currencies you use. - Verify your identity and connect local payment methods

Complete KYC, then link your bank account, card, or local payment service so you can deposit and withdraw in your own currency. - Follow local tax and regulatory guidance

Many jurisdictions treat bitcoin disposals (selling for cash or swapping for other assets) as taxable events, so trades may need to be tracked and reported in line with local rules.

The underlying “how to trade bitcoin” steps stay the same everywhere; what really changes from country to country is the regulation, tax treatment, and which exchanges and payment rails are available.

Quick FAQ: Short answers to common questions about trading Bitcoin

What is the minimum amount of money I need to trade bitcoin?

You can start with a small amount, but the most important thing is to only risk a small part of your account on each trade, not all of it.

Should you buy and hold bitcoin or trade it?

Buying and holding is easier and better for people who don’t want to watch the market every day. Trading can give you more chances, but it can also be more stressful and risky.

Is it possible for a complete beginner to day trade bitcoin?

You can start trading as a beginner, but keep in mind that it’s always better to start with small positions on longer timeframes and then move on to day trading once you have a clear plan and some experience. Avoid using margin at first. However, each individual needs to make their own decision based on their own risk tolerance.

How do I know when to sell or buy bitcoin?

Don’t trust your gut or what you see on social media; instead, use a written trading plan based on clear setups like trend, support/resistance, and breakouts.

Can you trade bitcoin all day and all night?

Yes, crypto markets are open 24/7, which is great, but you need rules so you don’t have to watch the screen all day and night.

Is it possible to trade bitcoin on my phone?

Most platforms have mobile apps, but it’s usually easier and safer to look at charts and make bigger trades on a desktop or laptop.

Do I have to pay taxes on bitcoin trades?

Selling or trading bitcoin is a taxable event. This means that you might have to keep track of your trades and report any gains or losses according to the rules in your area. Need to check at your jurisdiction before making any trade activity.

Can I lose more money than I put into bitcoin trading?

You can lose more than your initial margin if you use leverage when trading. However, with unleveraged spot trading, you can only lose your stake and not go below zero.

How long does it take to get good at trading bitcoin?

Most people need to practice, write about it, and improve their strategy for months or years. Treating it like a skill instead of a quick way to make money usually leads to better results.

Leave a Reply