Hedera (HBAR) is not a blockchain. That distinction matters, and understanding it changes how you evaluate the asset, who is building on it, and why Fortune 500 companies – not just crypto startups – are deploying it in production. If you are researching how to buy HBAR, this guide covers every method, platform, fee structure, and strategy in depth – starting with exactly what you would be buying and why it differs from everything else in the top 20 by market cap.

What Is Hedera (HBAR)?

Hedera is an enterprise-grade public distributed ledger technology (DLT) network. It was co-founded in 2018 by Dr. Leemon Baird – a computer scientist with a PhD from Carnegie Mellon University who invented the underlying Hashgraph algorithm in 2015 – and Mance Harmon, a technology executive with a master’s degree in computer science from the University of Massachusetts and a background in enterprise cybersecurity.

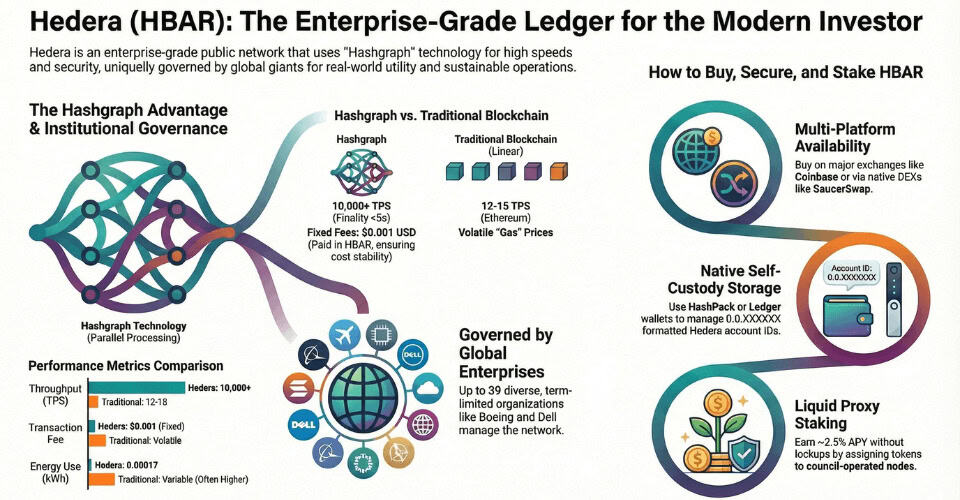

The critical technical distinction is that Hedera does not use a chain of sequential blocks. Instead, it uses a Directed Acyclic Graph (DAG) structure called Hashgraph. Where a traditional blockchain processes transactions one block at a time in linear sequence, Hashgraph processes multiple transactions in parallel, allowing the network to confirm thousands of operations simultaneously without congestion.

How Hashgraph Consensus Works

Hedera achieves consensus through two interrelated mechanisms: Gossip-About-Gossip and Virtual Voting.

In the Gossip-About-Gossip protocol, each network node randomly shares its transaction information with other nodes – and also shares metadata about which node it heard from and when. This metadata propagates through the network rapidly and uniformly, ensuring every node quickly builds a complete picture of transaction history without heavy communication overhead.

Virtual voting uses that shared history to allow nodes to mathematically calculate what every other node would vote, without actually transmitting explicit votes. This eliminates the communication bandwidth that makes other consensus systems slow and expensive.

The result is Asynchronous Byzantine Fault Tolerance (aBFT) – the highest standard of distributed consensus security. aBFT means the network can guarantee both the timing and order of all transactions even if some data is delayed, dropped, or actively manipulated. There is no fork condition, no possibility of a 51% attack (unlike proof-of-work chains), and no leader-based bottleneck.

Network Performance Specifications

Hedera’s performance profile is genuinely distinctive among public networks:

- Throughput: Up to 10,000 transactions per second (TPS) for HBAR transfers and token operations

- Finality: Transactions reach irreversible finality within 3–5 seconds

- Transaction fees: Average $0.001 USD per transaction, with fees fixed in USD and paid in HBAR

- Energy consumption: Hedera uses approximately 0.00017 kWh per transaction – less energy than a single Visa transaction – and has maintained carbon-negative status since 2021

- No gas price volatility: Unlike Ethereum, fees on Hedera are deterministic and do not spike during congestion

In 2022, the Hedera Governing Council purchased the intellectual property for the Hashgraph algorithm from Swirlds and committed it to open source under the Apache 2.0 license. The source code is now maintained under the Linux Foundation, making Hedera one of the few enterprise DLT projects with fully open-source, community-auditable code.

The Hedera Governing Council

Hedera’s governance model is what sets it structurally apart from every other top-20 crypto project. Rather than being controlled by an anonymous team, a single foundation, or venture capital investors, Hedera is governed by the Hedera Governing Council – a body of up to 39 globally diverse, term-limited organizations from across industry sectors.

Who Is on the Council?

Council members include organizations spanning technology, finance, energy, telecommunications, consumer goods, and academia. Confirmed members include:

Technology: Google, IBM, Dell Technologies, LG Electronics, Wipro, ServiceNow

Finance & Banking: Standard Bank, Aberdeen Investments, Archax, Lloyds Banking Group

Aerospace & Defense: Boeing

Telecommunications: Deutsche Telekom

Energy: Repsol, Blockchain for Energy (B4E)

Supply Chain & Distribution: Arrow Electronics

Other: Ubisoft (gaming), GBBC (Global Blockchain Business Council, first Strategic Partner)

Council members operate network consensus nodes, vote on software upgrades, manage treasury allocation, and set legal and policy direction. Each seat is term-limited to prevent any single organization from accumulating perpetual control. New member tiers were introduced in 2025, including Strategic Partners (organizations that participate in governance and ecosystem development without operating a full consensus node) and Community Partners.

Why Council Governance Matters for Investors

This council-based structure creates several properties relevant to HBAR holders:

Fork prevention: Because all major protocol changes require council approval, Hedera has never experienced a contentious fork. Your HBAR tokens will not be split between competing chains.

Enterprise credibility: Counterparties like JPMorgan, Swift, Lloyds, and Fidelity International do not build on networks governed by anonymous actors. The council structure provides the accountability framework institutions require.

Sybil resistance: Unlike open-validator networks, where bad actors can create thousands of anonymous validators, Hedera’s nodes are operated by identified, reputationally invested global enterprises. This dramatically reduces the attack surface for collusion or manipulation.

Controlled emission schedule: The council manages the HBAR token release schedule, preventing sudden supply shocks that could impair price stability.

HBAR Token: Utility, Supply, and Economics

HBAR is the native utility and staking token of the Hedera network. Its token economics are fixed by design, making its supply schedule one of the most predictable in the top 20 by market cap.

Total Supply and Distribution

The total supply of HBAR is permanently capped at 50 billion tokens – minted entirely at genesis in 2018. No new HBAR will ever be created beyond this fixed supply. The distribution allocated across stakeholder categories is:

- ~17% – Accredited investors from seed rounds and Series A funding

- ~23% – Team and employees (subject to multi-year vesting to prevent market dumping)

- ~16% – Hedera Governing Council members (for operating nodes and contributing governance)

- ~44% – Ecosystem incentives, developer grants, network node rewards, and future community initiatives

As of early 2026, approximately 43 billion HBAR are in circulation – roughly 86% of the maximum supply. The controlled release of the remaining supply is managed by the council’s treasury decisions.

HBAR Token Utility Functions

Network fee payment: Every transaction on the Hedera network requires payment in HBAR. This includes HBAR transfers, smart contract execution, token creation and management through the Hedera Token Service (HTS), file storage through the Hedera File Service, decentralized identity operations, and Hedera Consensus Service (HCS) message publishing. Every application built on Hedera generates HBAR fee demand proportional to its usage.

Network staking and security: HBAR holders can stake their tokens to consensus nodes operated by council members. Staked HBAR contributes to the proof-of-stake security model – the more HBAR staked to a node, the greater that node’s weight in consensus. This creates direct economic linkage between HBAR market participation and network security.

Anti-spam protection: Because every operation requires a real fee denominated in HBAR, spam attacks and denial-of-service floods are economically prohibitive – unlike zero-fee networks that are vulnerable to transaction flooding.

Treasury governance signal: While Hedera does not operate as a full token-weighted DAO, HBAR holdings and staking patterns serve as a signal in governance discussions around treasury allocation and network upgrades through the Hedera Improvement Proposal (HIP) process.

Fee Predictability as an Economic Property

Hedera’s decision to denominate fees in USD (paid in equivalent HBAR) rather than pure HBAR creates an unusual economic dynamic. When HBAR’s price rises, fewer HBAR tokens are needed to pay each transaction – but the underlying demand for HBAR to pay fees is driven by transaction volume, not token price speculation alone. This design benefits application developers who need predictable operating costs, and it means Hedera adoption creates consistent HBAR buy pressure regardless of market cycle.

Hedera’s Ecosystem and Real-World Deployments

Understanding who is actually building on Hedera – and what they are building – provides context that pure price charts cannot.

Tokenized Real-World Assets (RWAs): Lloyds Banking Group, Aberdeen Investments, and Archax executed the UK’s first foreign exchange trades using tokenized RWAs as collateral, powered by the Hedera network. This is a live production deployment, not a pilot announcement.

Carbon Markets: Verra – the world’s leading carbon market standards body – partnered with the Hedera Foundation to digitally transform global carbon markets using the Hedera Guardian platform. The five-year initiative integrates Guardian with Verra’s Project Hub, building the digital infrastructure for carbon credit issuance and retirement on Hedera’s immutable ledger.

AI Governance: EQTY Lab launched its Verifiable Compute solution on NVIDIA’s Blackwell platform, registering AI behavior and compliance proofs on the Hedera network. This is an early but significant deployment of Hedera as the trust layer for agentic AI systems – supported by SCAN UK and Accenture.

CBDC Infrastructure: Hedera’s partnership with Swift for CBDC and payment system interoperability positions the network within central bank digital currency infrastructure discussions globally.

Asset Tokenization Studio: Hedera integrated ERC-3643 (the T-REX standard for security tokens) into its Asset Tokenization Studio in 2025, enabling globally compliant, cross-border tokenized asset issuance directly on the Hedera network.

Supply Chain: Arrow Electronics joined the council specifically to develop a global supply chain initiative focused on standards and efficiency – a use case where Hedera’s immutable timestamping and low-cost HCS transactions provide direct business value.

HederaCon 2026 is scheduled for May 4, 2026 at the Faena Forum in Miami Beach – an indicator of the project’s active community and institutional presence.

Where to Buy Hedera (HBAR)

HBAR is listed on most major global exchanges and several US-regulated platforms. Here is a complete breakdown organized by platform type and use-case fit.

Top Centralized Exchanges (CEXs)

Binance offers the deepest global liquidity for HBAR. Available trading pairs include HBAR/USDT, HBAR/BTC, HBAR/ETH, and HBAR/USDC. Binance supports card purchases at approximately 1.8% over spot, $1 ACH deposit fee, and P2P markets for users in regions without direct fiat on-ramps. For users outside the United States, Binance.com is the primary platform. US residents are directed to Binance.US, which offers a more limited feature set but covers HBAR trading.

Coinbase and Coinbase Advanced Trade are the primary US-regulated options, consistently cited as the best starting point for beginners. Coinbase supports purchases starting at $1 using bank accounts, debit cards, Apple Pay, Google Pay, and PayPal. Coinbase Advanced Trade provides the full professional interface with lower maker/taker fees. As a publicly listed company (NASDAQ: COIN), Coinbase provides regulatory credibility and industry-leading insurance standards.

Kraken is a strongly regulated US and European exchange supporting HBAR against USD, EUR, and multiple stablecoins. Kraken Pro provides a professional trading interface with fees starting at 0.16% maker / 0.26% taker. Kraken accepts wire transfers, ACH, SEPA, and credit cards.

OKX lists HBAR with strong liquidity and supports purchases via credit card, bank transfer, and P2P. OKX’s non-custodial wallet product allows users to move between CEX trading and DeFi-adjacent applications without switching platforms – a useful feature for more advanced HBAR users.

MEXC is particularly popular for HBAR, offering HBAR/USDT, HBAR/USDC, and additional pairs. MEXC supports multiple regional payment methods and has published detailed Hedera content, reflecting its commitment to the token’s trading community.

Bybit provides competitive maker/taker fees on HBAR/USDT and supports card purchases, bank transfers, and P2P trading. Bybit is a strong option for users seeking lower costs on active HBAR trading.

Crypto.com supports HBAR with both exchange and non-custodial DeFi wallet access. The Crypto.com mobile app enables instant card purchases with delivery to either the exchange wallet or a personal wallet address.

BingX lists HBAR and supports multiple payment methods including bank transfer and card. BingX is widely used in Southeast Asia and offers copy trading functionality for users who want to mirror experienced traders’ HBAR positions.

Uphold is a multi-asset platform supporting HBAR via credit/debit card, bank account, or external crypto wallet. Uphold allows limit orders for users targeting a specific entry price, and supports trading between crypto, metals, and equities from a single account.

Robinhood supports HBAR for US investors with a commission-free, brokerage-style interface and 24/7 trading. The key limitation is the absence of external wallet withdrawals – HBAR purchased on Robinhood cannot be transferred to a personal wallet for staking or DeFi use.

Public.com allows HBAR purchases starting at $1 alongside stocks, ETFs, bonds, and options in a unified portfolio interface. HBAR trading on Public is powered by Apex Crypto. Public is particularly well-suited for investors who prefer a single dashboard across all asset classes.

Metal Pay (by Metallicus, Inc.) is a licensed US money transmitter that supports HBAR purchases via credit or debit card with low fees and no price spread manipulation. Available in the US, Australia, and New Zealand.

Fiat On-Ramp Services (No Exchange Account Required)

MoonPay supports HBAR purchases via credit card, debit card, Apple Pay, Google Pay, PayPal, Venmo, and multiple regional payment methods including UK Faster Payments, SEPA, and Pix (Brazil). MoonPay delivers purchased HBAR directly to your personal Hedera wallet address, making it ideal for buyers who want self-custody from the first transaction. Minimum purchase is $20 and service is available in 100+ countries.

Transak provides similar functionality as a fiat-to-HBAR on-ramp integrated directly into many Hedera-compatible wallets and DApps. It supports bank transfers and card purchases with delivery to external wallets.

Decentralized and Peer-to-Peer Options

Because Hedera is not an EVM chain natively, it does not have the same DEX ecosystem as Ethereum-based tokens. However, several options exist for decentralized and P2P HBAR acquisition:

SaucerSwap is the leading decentralized exchange built natively on Hedera. It operates through the Hedera Token Service (HTS) and allows users to swap HBAR for any HTS-native token and vice versa. After acquiring USDC or USDT on a centralized exchange and bridging to Hedera, SaucerSwap provides a fully on-chain swap environment.

HeliSwap is another native Hedera DEX with HBAR trading pairs and liquidity pools. Both SaucerSwap and HeliSwap require a Hedera-compatible wallet (HashPack is the standard) rather than MetaMask.

P2P on Binance and Bybit allow direct purchase of USDT from individuals using local payment methods, which can then be swapped for HBAR on the same platform.

Step-by-Step: How to Buy HBAR on a Centralized Exchange

The following steps apply broadly to Coinbase, Binance, Kraken, OKX, MEXC, and similar platforms.

Step 1 – Create Your Account and Complete Verification

Navigate to your chosen exchange and register with your email address and a strong, unique password. Use a password manager if possible, and ensure the password is not reused from any other service.

Most regulated exchanges require Know Your Customer (KYC) identity verification before purchases or withdrawals. This requires uploading a government-issued photo ID and completing a facial recognition or liveness check. Verification typically completes within minutes but can take up to 24 hours during peak periods.

Security setup is critical at this stage. Enable two-factor authentication (2FA) immediately using an authenticator app such as Google Authenticator, Authy, or Duo. Avoid SMS-based 2FA – SIM-swapping attacks specifically target crypto account holders by convincing mobile carriers to transfer your phone number to a device controlled by an attacker. If the exchange supports anti-phishing codes (a unique phrase embedded in all legitimate emails from the platform), enable these as well. They make phishing emails trivially identifiable.

Step 2 – Choose Your Deposit Method and Fund Your Account

ACH Bank Transfer (US): The lowest-cost deposit method. ACH transfers typically take 1–3 business days to clear, though some platforms provide immediate trading credit against the pending transfer. Coinbase, Kraken, and Gemini offer free ACH deposits. Binance charges $1.

Wire Transfer: Same-day settlement but carries bank-side fees of $15–$30 per transfer. Best for large single purchases where the fixed fee is proportionally small.

Credit or Debit Card: Fastest option – purchases settle in seconds, allowing you to buy HBAR within minutes of registration. Visa and Mastercard are universally supported. The cost premium is significant – typically 1.5%–3.5% above spot price on top of the standard trading fee. American Express support varies by exchange.

PayPal: Supported on Coinbase (US) and select other platforms. Convenient for users with existing PayPal balances but usually carries a fee premium similar to card purchases.

P2P (Peer-to-Peer): Available on Binance and Bybit. You buy USDT directly from individual sellers who accept any payment method they choose – Zelle, Venmo, CashApp, local bank transfers, etc. This method is particularly useful in regions where bank wire and card options are restricted or expensive.

Existing Crypto Deposit: If you hold Bitcoin, Ethereum, USDT, or any other supported asset, transfer it directly to the exchange and swap for HBAR. This avoids fiat deposit fees entirely and is the fastest path if you are moving from another platform.

Step 3 – Find the HBAR Trading Market

Once funded, search for “HBAR” or “Hedera” in the exchange’s search bar. Choose your trading pair based on what you deposited:

- HBAR/USDT – The most liquid global pair; best for users who deposited via USDT or stablecoins

- HBAR/USD – Direct fiat pair available on Coinbase and Kraken; shows price in familiar dollar terms

- HBAR/EUR – Available on Kraken and Binance for European users

- HBAR/BTC – For experienced traders positioning HBAR relative to Bitcoin

- HBAR/KRW and HBAR/INR – Regional fiat pairs available on select exchanges for Korean and Indian markets

For first-time buyers, HBAR/USDT or HBAR/USD is recommended. It provides the clearest dollar-denominated pricing without introducing Bitcoin’s price volatility into your calculations.

Step 4 – Select Your Order Type and Execute

Market Order: Buys HBAR immediately at the best available price. Execution is instant. The exchange displays an estimated receive amount and exact fee before you confirm. Market orders are best for purchases where speed matters and order size is manageable relative to the trading pair’s daily liquidity. For HBAR on Binance or Coinbase, orders under $10,000 typically execute with negligible slippage.

Limit Order: You specify the exact maximum price per HBAR you are willing to pay. The order queues in the exchange’s order book and executes automatically when the market reaches your target. Limit orders give you precise cost control and typically qualify for lower “maker” fees because they add liquidity to the order book rather than immediately consuming it. This is the preferred method for larger purchases or when you want to enter at a specific level below current market price.

Dollar-Cost Averaging (Recurring Buy): Most major exchanges – including Coinbase, Binance, and Kraken – offer automated recurring purchase schedules. You set a fixed dollar amount and an interval (daily, weekly, or monthly), and the exchange executes the purchase automatically. This eliminates the psychological burden of timing decisions and is particularly rational for HBAR given its historical price volatility cycles.

Before confirming any trade, review the fee breakdown line-item carefully. It shows exactly what the exchange is charging. Confirm once satisfied.

Step 5 – Secure Your HBAR

HBAR held on a centralized exchange is custodial – the exchange holds the private keys to your funds. For any amount you don’t need for active trading, transferring to a self-custody wallet reduces counterparty risk significantly.

To withdraw, navigate to the exchange’s withdrawal section. Select HBAR and enter your personal Hedera wallet address. The Hedera network uses a unique account identifier format (0.0.XXXXXXX) that differs from Ethereum-style addresses. Double-check this address character by character before confirming – all cryptocurrency transactions are irreversible. The exchange deducts a flat withdrawal fee covering the on-chain transaction cost.

Step-by-Step: Buying HBAR on SaucerSwap (Native DEX)

This method gives you full self-custody without ever interacting with a centralized exchange. It requires some initial setup but is the preferred approach for users who want to immediately use their HBAR in Hedera DeFi.

Step 1 – Install HashPack Wallet. HashPack is the community’s primary Hedera-native wallet, available as a browser extension (Chrome, Brave) and as a mobile app (iOS and Android). Create a new wallet. Store your 24-word recovery phrase securely offline – never in a photo, cloud storage, or email. HashPack uses Hedera’s native account system, which means you will receive a unique Hedera account ID (format: 0.0.XXXXXXX) upon creation.

Step 2 – Fund HashPack With HBAR. The simplest path is to buy a small amount of HBAR on Coinbase or Binance first, then withdraw to your HashPack wallet address. This initial amount gives you HBAR to pay for subsequent transactions on the network.

Step 3 – Bridge USDC or USDT to Hedera (Optional). If you want to swap stablecoins for HBAR on SaucerSwap, use the official Hedera bridge at hedera.com or a supported third-party bridge to move USDC from Ethereum or Polygon to the Hedera network. This is an optional step – you can also simply buy HBAR directly using a centralized exchange and withdraw.

Step 4 – Connect to SaucerSwap. Visit saucerswap.finance and click “Connect Wallet.” Select HashPack from the wallet options. SaucerSwap reads your wallet balance and constructs transactions for your approval – it never takes custody of your assets.

Step 5 – Execute the Swap. Select your input token (USDC, USDT, or any HTS token) and set HBAR as the output. Review the quoted price, estimated price impact, and minimum received amount. Click Swap, then confirm the transaction in HashPack. Transactions on Hedera finalize in under 5 seconds. Your HBAR appears in your HashPack balance immediately.

How Much Does It Cost to Buy HBAR?

There is no meaningful minimum purchase requirement. Coinbase and Public.com support $1 minimum purchases. MoonPay’s minimum is $20. At HBAR’s current price range of approximately $0.07–$0.20, a $50 investment buys between 250 and 700 HBAR tokens.

Fee Breakdown by Method

| Method | Typical Fee |

|---|---|

| ACH bank transfer deposit | Free (Coinbase, Kraken) or $1 (Binance) |

| Credit/debit card deposit | 1.5% – 3.5% over spot |

| PayPal deposit | ~1.5% – 2.5% premium |

| Exchange trading fee (maker) | 0.01% – 0.16% |

| Exchange trading fee (taker) | 0.05% – 0.26% |

| HBAR withdrawal to external wallet | ~0.01 – 0.5 HBAR flat fee |

| SaucerSwap DEX swap fee | 0.30% of trade value |

| MoonPay on-ramp fee | ~1.0% – 4.5% depending on method |

Gas fees in the traditional Ethereum sense do not apply on Hedera. Network fees are fixed in USD terms at approximately $0.001, making transaction costs predictable regardless of network congestion.

HBAR Wallets: Storage Options Explained

Where you store HBAR is as important as where you buy it. Hedera uses its own native account structure, which is different from Ethereum’s address format. Not all EVM wallets support HBAR without specific configuration.

Exchange Wallets (Custodial)

Leaving HBAR on a regulated exchange like Coinbase or Kraken is the simplest approach for active traders who need rapid access to sell or swap. The tradeoff is trust – you rely on the exchange’s security, solvency, and operational continuity. For amounts you actively trade, this is pragmatic. For long-term holdings, self-custody is recommended.

HashPack Wallet (Hedera-Native, Self-Custody)

HashPack is the most widely used and community-trusted Hedera-native wallet. It is available as a browser extension and mobile app. HashPack supports:

- Native HBAR storage and transfers

- All Hedera Token Service (HTS) tokens and NFTs

- Native HBAR staking directly from the wallet interface

- Full DeFi access (SaucerSwap, HeliSwap, and all Hedera DApps)

- Integration with Ledger hardware wallet for cold storage signing

HashPack is the recommended wallet for any HBAR holder who intends to stake, use DeFi applications on Hedera, or hold tokens long-term with self-custody.

Blade Wallet

Blade is another Hedera-native self-custody wallet with a focus on simplicity and mobile-first design. It supports HBAR, HTS tokens, and basic DeFi functionality. Blade is a good alternative for users who prefer a lighter interface than HashPack.

Tangem Wallet (Hardware, Mobile-Based)

Tangem is a card-form-factor hardware wallet that stores private keys on a physical NFC chip embedded in a credit-card-sized device. It supports HBAR natively and requires no battery or screen – you tap the card to your phone to sign transactions. As of 2025, staking through Tangem is not yet supported, but basic HBAR storage and transfers function fully.

Ledger (Ledger Nano X / Nano S Plus)

Ledger supports HBAR through the Ledger Live application and can be connected to HashPack for DeFi signing. The private key never leaves the Ledger device, making it the gold standard for long-term storage. The Ledger Nano X supports Bluetooth for mobile signing; the Nano S Plus is USB-C only and more affordable. If your HBAR holding is meaningful in size, a Ledger is the recommended storage solution.

MetaMask (Limited Support)

MetaMask natively supports Ethereum and EVM-compatible chains. HBAR is not an ERC-20 token, so standard MetaMask does not support native HBAR staking or Hedera DApp interactions. Some wrapped or bridged HBAR representations exist on EVM chains, but these are not the canonical Hedera-native HBAR token.

HBAR Staking: Earning Passive Rewards

Staking HBAR is one of the most straightforward staking experiences in the top 20 by market cap. Hedera uses a proxy staking model – your HBAR never leaves your wallet and is never locked in a smart contract. You are simply assigning the staking weight of your balance to a specific network node.

How Proxy Staking Works

When you stake HBAR in HashPack:

- You select one of the council-operated consensus nodes (27 nodes as of late 2024)

- Your full HBAR balance is automatically assigned to that node

- Your funds remain completely liquid – you can transfer, swap, or unstake at any time

- You begin accumulating rewards after a 24-hour minimum staking period (periods begin and end at midnight UTC)

- Rewards are claimed manually via the “Collect Rewards” button in HashPack

Staking APY: The Hedera Governing Council voted to implement a maximum annual reward rate of 2.5%. All nodes pay approximately the same reward rate at any given time. The council reserves the right to adjust rates as network adoption grows and as the balance between emission-based and fee-based rewards shifts over time.

No lockup, no slashing, no minimum amount: Unlike Ethereum staking (which requires 32 ETH and has slashing penalties) or many DPoS systems (which lock funds for days), Hedera staking is entirely non-custodial, non-binding, and penalty-free for stakers. There is no minimum HBAR requirement to begin staking.

How to Start Staking in 3 Steps

Step 1: Install HashPack and transfer your HBAR from an exchange to your HashPack wallet address.

Step 2: Open HashPack, navigate to the Stake tab, and press “Stake your HBAR.” Select any council node from the list – all pay equivalent rates.

Step 3: Confirm the stake assignment. After 24 hours, press “Collect Rewards” to claim HBAR rewards to your balance.

Staking via DeFi Alternatives

Beyond native staking, HBAR can be deployed as liquidity in SaucerSwap’s pools to earn trading fees plus potential SAUCE token rewards. This carries additional smart contract risk compared to native staking but offers the potential for higher combined yield. Advanced users can also supply HBAR to lending protocols building in the Hedera ecosystem for additional yield opportunities.

Investment Analysis: HBAR’s Value Thesis and Risk Profile

The Bull Case for HBAR

Fixed, predictable supply: With 50 billion total tokens and 86% already in circulation, HBAR’s remaining supply dilution is modest and schedule-driven rather than governance-dependent. There will never be more than 50 billion HBAR.

Fee-driven demand mechanism: Every transaction on Hedera requires HBAR to pay fees denominated in USD. As enterprise adoption grows – tokenized assets, CBDC infrastructure, carbon markets, AI governance – HBAR buy pressure from fee payment scales proportionally. This is structural demand, not speculative.

Institutional partnership depth: The combination of Lloyds Banking Group, Aberdeen Investments, NVIDIA, Verra, Swift, Repsol, Boeing, Google, IBM, and Deutsche Telekom as either council members or active deployment partners is unmatched by any other non-Ethereum DLT project. These are not press release partnerships – they are production deployments with documented transactions on the Hedera network.

Carbon-negative infrastructure: ESG-focused institutional capital increasingly avoids proof-of-work chains. Hedera’s energy consumption profile – less than a Visa transaction per operation – makes it compatible with environmental governance frameworks that exclude Bitcoin and some other PoW networks.

ETF speculation: In 2025, increasing institutional interest in HBAR ETF products began surfacing in financial commentary. While no standalone HBAR ETF had been approved as of early 2026, the regulatory climate expanding beyond Bitcoin and Ethereum creates a longer-term possibility.

HederaCon and community growth: The scheduling of HederaCon 2026 at the Faena Forum in Miami Beach signals an active, institutionally attended community – not a dormant ecosystem.

Risk Factors to Understand

Council centralization tradeoff: The Governing Council provides enterprise trust and fork resistance but represents a meaningful centralization of governance relative to fully permissionless blockchain networks. If council members disagree or if the council itself were compromised, protocol direction could shift in ways retail holders cannot influence directly.

HIP process limitations: While the Hedera Improvement Proposal (HIP) process is open to community participants, ultimate decision authority rests with the council. HBAR holders do not have direct token-weighted voting power over protocol changes.

EVM competition: Hedera is not EVM-native, meaning the vast developer tooling, DeFi protocols, and wallet infrastructure built for Ethereum do not automatically port to Hedera. HyperEVM-equivalent capabilities require specific SDK adoption. This creates a higher integration barrier compared to EVM-compatible L1s and L2s.

Price history context: HBAR reached an all-time high of $0.51 in September 2021. It traded below $0.05 during the 2022–2023 bear market. As of early 2026, it trades at approximately $0.07–$0.12, representing an 80%+ decline from peak – a pattern common across the crypto market but a data point requiring honest acknowledgment for any investor evaluating entry timing.

Supply approaching max: With 86% of total supply already circulating, the remaining 14% (~7 billion HBAR) in treasury and ecosystem reserves still represents meaningful future supply if released rapidly. The council’s management of this reserve is a risk factor worth monitoring through official treasury updates.

Hedera vs. Competing Networks

Hedera vs. Ethereum

Ethereum is the dominant smart contract platform and developer ecosystem. HBAR does not compete for Ethereum’s DeFi-native user base. Hedera competes for enterprise deployments where Ethereum’s gas costs, throughput limitations, and permissionless validator structure create barriers for regulated financial institutions. Hedera wins on performance metrics; Ethereum wins on ecosystem depth and developer adoption.

Hedera vs. XRP Ledger

XRP and HBAR often attract similar investor profiles due to shared emphasis on fast, low-cost transactions and institutional finance partnerships. Key differences: XRP Ledger uses a federated consensus with trusted validators, while Hedera’s aBFT Hashgraph provides mathematically stronger finality guarantees. Ripple (XRP’s parent) has faced prolonged SEC litigation; Hedera’s governance structure has generally navigated regulatory scrutiny more smoothly. Both are top competitors for CBDC infrastructure contracts.

Hedera vs. Stellar (XLM)

Stellar competes in payments and cross-border settlement, with strong central bank partnerships (particularly in the Global South). Hedera has a broader enterprise service layer (token service, consensus service, smart contracts) and a higher-profile governing council. Stellar has deeper payment-focused ecosystem maturity.

Hedera vs. Avalanche

Avalanche is an EVM-compatible L1 with subnets for custom chain deployment. It is faster than Ethereum mainnet and popular for institutional subnet deployments. Hedera has lower per-transaction fees and higher raw TPS for its native transaction types. Avalanche has a dramatically larger DeFi and developer ecosystem. They compete for enterprise tokenization mandates – a market large enough for multiple winners.

HBAR: Frequently Asked Questions

Can US residents buy HBAR? Yes. HBAR is available on Coinbase, Kraken, Robinhood, Public.com, Uphold, and Binance.US – all accessible to US investors. Availability may vary by state for some platforms.

What is the minimum amount of HBAR I can buy? No meaningful minimum exists. Coinbase and Public.com allow $1 purchases. MoonPay’s minimum is $20. At current prices, $10 buys roughly 50–140 HBAR depending on market conditions.

Is HBAR an ERC-20 token? No. HBAR is the native token of the Hedera network, not an Ethereum-based token. Bridged or wrapped HBAR representations exist on EVM chains, but the canonical HBAR used for staking and Hedera DApps is the native Hedera token managed through accounts in HashPack or Ledger.

Does Hedera have smart contracts? Yes. The Hedera Smart Contract Service is EVM-compatible, meaning Solidity smart contracts can be deployed on Hedera. However, gas costs and transaction mechanics differ from Ethereum mainnet. Native Hedera services (HTS, HCS) are more widely used in production deployments than the smart contract layer.

How do I stake HBAR? Transfer HBAR to a HashPack wallet, navigate to the Stake tab, select a council node, and confirm. Rewards begin accruing after 24 hours and are collected manually. Your HBAR remains fully liquid and is never locked or sent to a third party.

What is the staking reward rate for HBAR? The Hedera Governing Council has set a maximum annual rate of 2.5%. All nodes pay approximately the same rate at any given time. The council can adjust this rate as network adoption grows.

Is Hedera the same as a blockchain? No. Hedera uses Hashgraph, a Directed Acyclic Graph (DAG) architecture, not a traditional chain of blocks. The distinction enables parallel transaction processing, higher throughput, and stronger consensus finality compared to sequential blockchains.

Does buying HBAR give me governance rights? Directly, no. Governance decisions are made by the Hedera Governing Council. Community members can submit and comment on Hedera Improvement Proposals (HIPs), and staking patterns signal community sentiment – but formal on-chain token-weighted governance does not currently exist in Hedera’s design.

What wallet should I use for HBAR? HashPack is the community standard and is required for native staking and all Hedera DApp interactions. Ledger hardware wallets support HBAR for cold storage and can be connected to HashPack for DeFi signing. Tangem supports basic HBAR storage in card form. Standard MetaMask does not support native HBAR.

Is there a Hedera ETF? No standalone HBAR ETF exists as of early 2026. Institutional interest in HBAR ETF products has grown in financial commentary, but no product has been approved by the SEC. The regulatory framework for non-Bitcoin, non-Ethereum spot crypto ETFs remains under development.

Final Thoughts

Hedera occupies a specific and defensible niche: it is the only public distributed ledger network governed by a council of identifiable global enterprises, running on a consensus algorithm with mathematically proven aBFT security, achieving carbon-negative status at commercial scale, and actively deployed in live financial market infrastructure by institutions like Lloyds Banking Group, Aberdeen Investments, and Swift.

Buying HBAR is straightforward across a dozen platforms. Coinbase and Binance provide the most accessible entry points globally. MoonPay and Transak offer self-custody-first purchases with card or bank transfer. For users ready to engage the full ecosystem, HashPack + SaucerSwap provides a fully on-chain experience with native staking in the same wallet.

What requires more consideration is position sizing, investment timeline, and honest risk assessment. HBAR is an infrastructure token in a network competing for enterprise DLT mandates – a market that moves on institutional adoption timelines measured in years, not quarters. Its price history reflects the volatility common to all top-20 assets. Its fundamental profile – fixed supply, real enterprise deployments, predictable fee economics, and council-managed stability – provides a thesis distinct from most DeFi-native tokens. Whether that thesis plays out in price is a question every investor must answer for themselves.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial or investment advice. Cryptocurrency investments are highly volatile and speculative. Always conduct your own thorough research and consult a qualified financial professional before making investment decisions. Past price performance is not indicative of future results.

Leave a Reply